导言

在数字货币的世界里,各种新兴的钱包与DApp层出不穷,tokenim钱包作为一种新型的数字货币存储工具,吸引了不少用户的关注。特别是其声称可以存币生息的功能,令许多投资者心动。然而,关于tokenim钱包的生息模式的真实性,市场上却充斥着疑惑与传言。通过深入分析,我们将探讨tokenim钱包是否真的如其所承诺的那样,提供安全可靠的投资机会,还是说这是一场精心策划的骗局。

一、什么是Tokenim钱包?

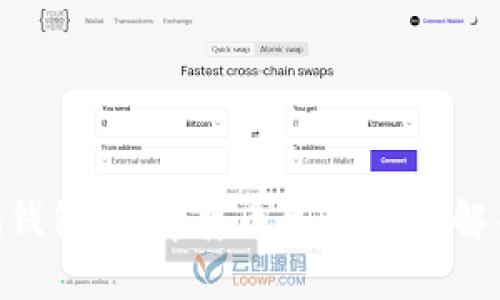

Tokenim钱包是一款声称支持多种主流数字货币的数字钱包应用,用户可以在平台上进行数字货币的存储、转账及交易。此外,Tokenim钱包还推出了DApp功能,允许用户通过其钱包进行生息投资。用户只需将资金存入Tokenim钱包的生息项目中,便可以在一定时间内获得利息收益。这样的服务在数字货币领域初显其价值,但也因为其高回报率而引发了诸多质疑。

二、DApp生息模式概述

在Tokenim钱包中,DApp提供的生息模式让用户可以通过锁定自己的数字资产,享受生息收益。通常,这样的模式会通过某种方式,即借助智能合约等去中心化技术,确保资金的透明和收益的可追溯性。然而,DApp的生息往往伴随着较高的风险,特别是在价值波动较大的数字货币市场。用户需明确风险,谨慎选择。

三、Tokenim钱包生息骗局的常见特征

在分析Tokenim钱包是否存在骗局之前,我们首先要明确一些常见的骗局特征。许多骗局往往具备如下特征:

- 高额的回报率承诺:骗子往往承诺超出市场常规的高额回报,以抓住用户的心理。

- 缺乏透明度:如果平台关于其运作方式、资金流向或者项目背景缺乏清晰说明,则需警惕。

- 时间压力:一些骗局会对用户施加时间压力,迫使他们快速做决定,而不允许充分的思考和研究。

- 在线客服蟑螂般的反应:骗局网站的客服往往反应迅速,其实是为了转移用户注意,误导投资方向。

四、如何识别Tokenim钱包中的骗局?

用户在使用Tokenim钱包进行生息投资时,应保持谨慎,观察以下几个方面可能的风险:

- 查询项目的合法性:可查找相关的法律文件和公司注册信息,确保项目背景合法合规。

- 社区声音:加入相关讨论社群,听取其他用户的经验,警惕那些利用虚假评论吸引用户的情况。

- 资金安全性:确保使用的钱包具有一定的安全性防护机制,比如两步验证、冷存储等。

五、针对Tokenim钱包的相关问题分析

Tokenim钱包的合规性如何?

To provide detailed insights regarding the compliance of Tokenim wallet, we first need to analyze the regulatory landscape of cryptocurrencies in the respective jurisdiction. Generally, digital wallets often operate in a grey area of the law. They may not be adequately registered or regulated by the necessary financial authorities. The lack of proper regulation can expose users to risks, including a potential loss of funds due to fraudulent activities. In many countries, cryptocurrency regulations are still evolving, and thus, users should conduct thorough research regarding the legal status of the Tokenim wallet in their country.

Moreover, understanding the importance of compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is crucial. Many legitimate wallets require users to verify their identity to ensure compliance with various laws, while scams typically avoid this process. Furthermore, potential users should check if Tokenim wallet has the necessary licenses to operate as a crypto wallet, as these licenses serve as a safeguard against fraudulent activities.

For a comprehensive understanding, it’s also advisable to explore if there have been any regulatory actions taken against Tokenim or its creators. Any historical data regarding warnings or penalties imposed can provide deeper insights into the legitimacy of their operations. Overall, users must navigate these complexities carefully to ascertain the legitimacy of Tokenim wallet and its operations in the sphere of digital currencies.

Tokenim钱包的安全性如何?

The safety of Tokenim wallet is another pivotal aspect that requires thorough evaluation. Safety can be assessed on multiple fronts, including the technology used to secure user data and assets, user reviews regarding security incidents, and the presence of any vulnerabilities that have previously been exploited.

Firstly, it is essential to dissect the wallet's security protocols. Is it implementing advanced encryption techniques to safeguard user data? Are there any public disclosures regarding their security audits? Thorough due diligence around these questions can help in assessing the credibility of Tokenim's security infrastructure.

Additionally, examining the real-user experience can yield invaluable insights. If users have reported significant security breaches or fund losses, it raises a red flag about the overall safety of the wallet. Investigate any discussions on forums or social media that highlight potential security issues users have faced with Tokenim. Often, community-driven investigations can reveal patterns not disclosed by the company itself.

Moreover, examining the technology behind Tokenim, including the nature of its blockchain infrastructure and any potential vulnerabilities that may render it susceptible to attacks can provide insight into the reliability of stored assets. Assessing the presence of two-factor authentication, regular security updates, and responsiveness to reported issues is crucial in this analysis.

生息模式的可持续性如何?

The viability of Tokenim's yield model is critical for existing and prospective investors. Understanding the underlying mechanisms that generate yields is the cornerstone of this inquiry. Often, platforms that guarantee substantially high returns must bridge the gap between appealing offers and actual revenue-driving activities.

Firstly, delving into the revenue model of Tokenim wallet is essential. How exactly does the DApp allocate funds? Is it through yield farming, liquidity provision, or other forms of financial instruments? The sources of returns should be clearly articulated, as lack of transparency in these operations often leads to unsustainable and fraudulent practices.

Separately, market conditions play a crucial role in analyzing the sustainability of earnings. Digital currencies fluctuate, and a system that promises fixed earnings without adequately addressing these fluctuations might inherently carry risks. Assess how fluctuations in the market might impact the earnings promised by Tokenim and whether the yields offered are realistic given these conditions.

The regulatory framework can also affect the sustainability of the yield model. With ever-changing regulations, the operational feasibility of Tokenim wallet’s yields can be challenged. Therefore, understanding how adaptable Tokenim is to regulations should be part of the analysis regarding the longevity of its yield model.

用户如何保护自己在Tokenim钱包的投资?

Protecting oneself while using Tokenim wallet requires a multifaceted approach, combining education, vigilant monitoring, and proactive risk management. Users must first equip themselves with as much knowledge as possible regarding the intricacies of cryptocurrency investment. This includes understanding not only how Tokenim operates but also grasping general principles around digital asset management.

Next, the importance of diversifying investments cannot be overstated. Placing all assets into a single platform increases exposure to concentrated risks, so holders need to consider spreading investments across different wallets or assets. This practice can reduce damage in case of a sudden market downturn or issues related to Tokenim's functionality.

Regular monitoring of one’s investments is also vital. Users should keep tabs on any updates or changes in Tokenim wallet’s policies, security breaches, and new regulations that might perceive risk. Being connected with the community through forums or social media can provide valuable real-time insights into users’ experiences and prompt changes that could impact their investments.

Lastly, employing best practices in security hygiene—such as using strong, unique passwords, enabling two-factor authentication, and regularly updating their devices—can help mitigate risks associated with potential hacks or unauthorized access to funds. Overall, through education, diversification, vigilant monitoring, and robust security practices, users can greatly enhance their protection while utilizing the Tokenim wallet.

总结

随着数字货币市场的不断发展,Tokenim钱包及其相关的DApp生息功能吸引了越来越多的关注与使用。然而,在享受高收益的同时,用户也必须意识到潜在的风险与骗局。通过深入分析Tokenim钱包的合规性、安全性、生息模式的可持续性以及有效的自我保护措施,我们能够更全面地理解这一钱包带来的机遇与挑战。始终保持谨慎、了解市场动态,并凭借自身的决策能力,才能在数字货币的海洋中稳健前行。通过这种方式,用户能够利用Tokenim钱包提供的功能,而不被潜在的骗局所笼罩。

(内容大致3200字)